QOZB Capital Elevates Zero Coupon Note Yield to 10% APR

Effective immediately, QOZB Capital has raised the yield on its Zero Coupon Notes to an impressive 10% APR.

Most investors have focused on the real estate investment side of the federal opportunity zone program, but many are missing out on a part of the program that could generate far greater returns, experts said.

The returns on investing in a high potential company that sets up as a qualified opportunity zone business, or QOZB, and starts or relocates in one of the designated 8,700 opportunity zones could be 10 times more profitable than flipping commercial real estate, The Pearl Fund founder and Managing Partner Brian Phillips said.

“For real estate, you may get two times your money back, triple, maybe quadruple, but we don’t even think about investing in a [QOZB] if we don’t at least get a 10 times return on it. It’s huge potential but it’s also higher risk,” said Phillips, who launched New York-based The Pearl Fund in May.

The Pearl Fund bills itself as the first qualified opportunity zone fund focused solely on providing venture capital to QOZBs. Phillips said he plans to raise $25M from investors with capital gains who are seeking tax-free venture capital returns.

Proponents says if it is successful, a QOZB will grow, create a lot of jobs and support the smaller businesses in an opportunity zone community.

“That can yield much more significant return than you can in real estate investing and there is a much greater impact on the community,” he said. “It’s nice to have that double impact.”

Since passage of the opportunity zone program, much of the attention has been focused on putting money and investing in commercial real estate deals in designated opportunity zones.

The Department of the Treasury and Internal Revenue Service clarified rules surrounding QOZBs in April, more than a year and a half after the passage of the bill. But Phillips said he believes investors will only begin to turn their attention to this component in the next 12 to 18 months.

Though commercial real estate got a big head start, Phillips said, the real estate component and business side of the federal program complement each other.

“There are some smart developers in the commercial space who are thinking ahead … adding a QOZB fund [to complement their projects],” Phillips said.

The stated purpose of the OZ program is to uplift low-income, distressed neighborhoods, while providing significant tax breaks and spurring investment.

Opponents of the program say it is just a tax break for rich investors and that investments without community input could lead to residents being displaced and gentrification, with some even calling it “gentrification on steroids.” Sen. Tim Scott (R-S.C.), who co-sponsored the bill that created the program, is already threatening to kill the program if itsn’t benefiting the entire community.

Passed as part of the Tax Cuts and Jobs Act of 2017, the program allows investors to roll over both short- and long-term capital gains into a qualified fund, so long as the investment is made in one of the 8,700 zones that have been certified by the Treasury Department.

Experts said that may have lead to some myopia. Over the past 18 months a majority of the discussion has centered on real estate, OPZ Bernstein principal Craig Bernstein said. OPZ Bernstein is a Washington, D.C.-based opportunity zone fund manager.

Most people don’t realize that you can also apply the benefits to other types of investments, Bernstein said. That includes existing operating businesses, startups, infrastructure improvements and alternative energy projects.

In exchange for investors committing long-term capital into one of these lower-income communities, investors will be eligible for three primary benefits:

There are at least six states, including California and Massachusetts, that currently are either not fully conforming to the program.

To qualify as a QOZB, a business has to earn at least 50% of its gross income from business activities within an opportunity zone, according to the IRS. A business must meet the criteria of one of the safe harbors:

Traditional “sin businesses” as previously defined by the IRS — for example, massage parlors, strip clubs, liquor stores and casinos — would be prohibited.

Triple net leases are also not allowed.

Investors looking to roll over realized capital gains into an opportunity zone fund have two options to qualify, Bernstein said.

If the initial investment was held by an individual, the investor has 180 days to redeploy the capital into an opportunity zone fund. If the initial investment was held in a partnership or corporation, the entity can redeploy the capital either 180 days after the gain has been realized, or the following year between Jan. 1 and June 30 to place it in a qualified opportunity zone fund, Bernstein said.

There have been some discussions on whether cannabis operations/companies would be considered as a QOZB if set up in an opportunity zone.

Though the initial legislation, which was written several years ago, did not specifically address cannabis businesses as acceptable or prohibited, U.S. Secretary of the Treasury Steven Mnuchin told Congress that the intent of the opportunity zone legislation was not to include cannabis as a business that would qualify as part of the program.

“To date, though, a majority of capital flowing into opportunity zone funds has been utilized for traditional ground-up development,” Bernstein said.

People are still learning more about the program, he added.

“We are only in the second inning,” he said. “Over the next year, I expect you will start to see both landlords and tenant rep brokers start to promote the benefits of the opportunity zone program to prospective tenants.”

A QOZB database built by Compound, which is a QOZB based in New York, lists fewer than two dozen companies as QOZBs.

Bernstein said that in the 20 years, venture capital firms have created hundreds of billions of dollars of value for their investors. Many of these portfolio companies were started with an initial seed investment.

“Obviously, at the time the opportunity zone program wasn’t in existence, but could you imagine if Mark Zuckerberg’s initial investment in Facebook would have been structured as an opportunity zone fund investment?” Bernstein said. “As time progresses, I would be shocked if these firms didn’t require future portfolio companies to set up shop within an opportunity zone, as a condition of making an investment within the company.”

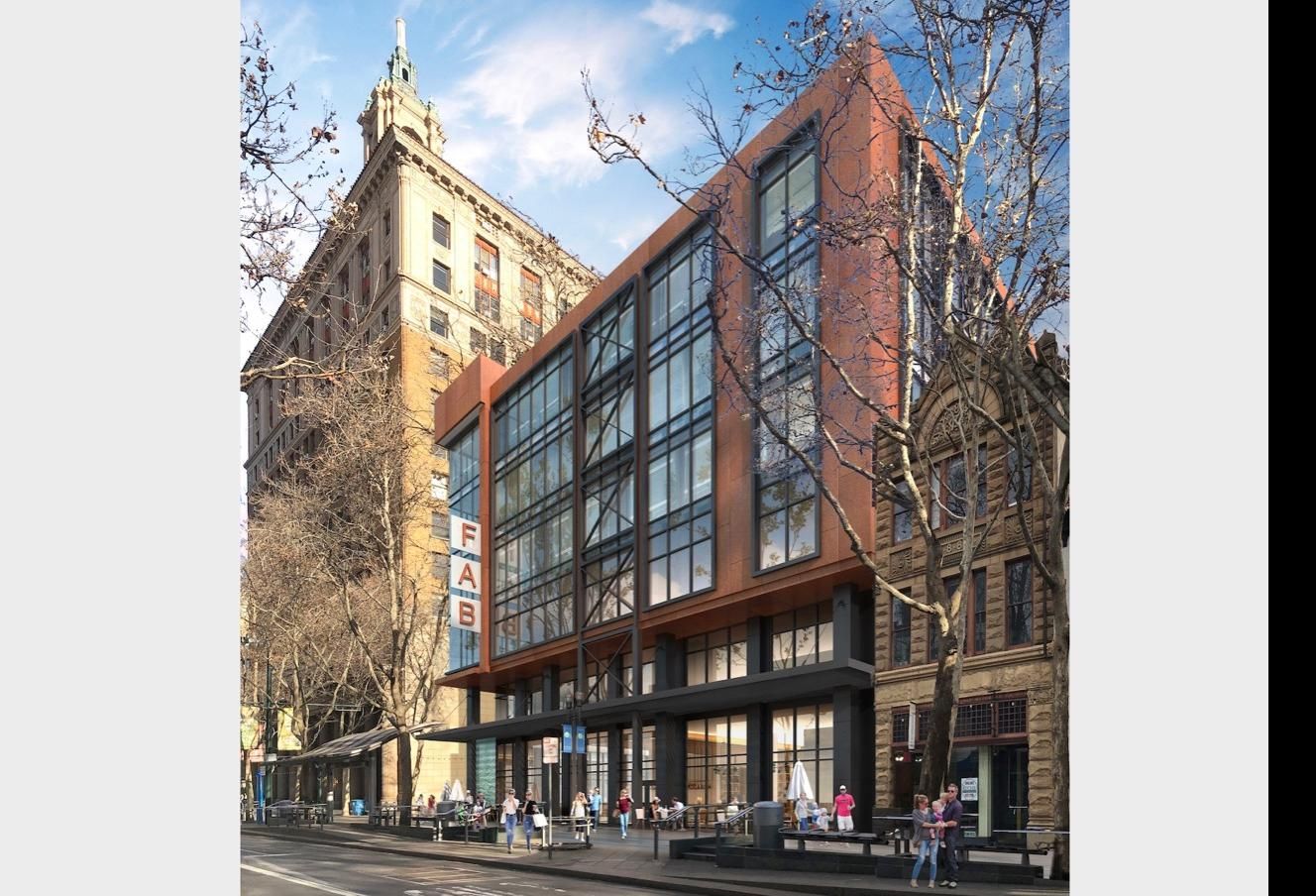

San Jose-based Urban Catalyst founder Erik Hayden said his goal is to lure 100 QOZB startups to downtown San Jose. That would effectively make the entire area one huge incubator.

Hayden, who is raising $250M in a qualified opportunity fund for 10 projects in downtown San Jose, said he has been actively discussing the benefits of investing in or starting a QOZB to various venture capital companies, angel investors and local chambers of commerce in the Bay Area.

“In our outreach, blog posts, meetings and everything we put out there, we are reinforcing qualified opportunity zone business is possible and that San Jose is the place to locate if you want to start a startup in Silicon Valley,” Hayden said.

Hayden said he is in the process of building several developments in downtown San Jose. Of the seven different opportunity zone sites his company has already acquired, two will be for office buildings of 55K SF and 75K SF.

“These will be multi-tenant buildings. We are building space for this type of [QOZB] investment,” Hayden said. “We tell them opportunity zone businesses are going to be locating here, and you guys should think about forming an opportunity zone fund and funding startups through that fund, so that the next Uber is an opportunity zone company.”

Hayden added that he believes startups that set up as a QOZB will have a higher chance of getting financing from investors because of the extra incentives set forth in the opportunity zone program.

For Phillips, investing venture capital in a qualified opportunity zone fund to start or invest in QOZBs is the next wave in the ever-evolving opportunity zone program.

Phillips is a serial entrepreneur and has helped found several startups that have either gone public or been acquired. He has also worked for Goldman Sachs’ 10,000 Women Initiative, which helped women entrepreneurs in Africa, India, China and Latin America start their own businesses. He says he has seen firsthand the impact of promoting entrepreneurship in distressed areas.

“I have seen how this has worked,” Phillips said. “I know it works and I’ve seen the great impact that entrepreneurs can have on an economy in the Third World. It certainly can happen in low-income census tracts.”

Phillips said setting up a QOZB fund was difficult; it took him and his team nine months to set one up. But the learning process was well worth it — he has already helped a half-dozen or so people set up their own qualified opportunity zone funds to fund QOZBs.

He said it is going to take a movement for this program to pick up steam. Unlike commercial real estate, where several big firms have set up qualified opportunity zone funds to invest in opportunity zone projects, he sees a lack of interest from the business community. Private equity, big venture funds and financial firms that normally would invest have yet to step up.

“We’re not seeing the movement of really large massive companies in the industry moving in like we did in real estate,” Phillips said. “It’s going to take serial entrepreneurs, people in the community … It’s going to take a movement of many hundreds, if not thousands, of individuals setting up small funds and business funds to invest in these communities. That’s going to take a while. It’s building and it’s going to start.”

The holy grail, as Phillips calls it, is being able to fund the next Apple or Google. But even if that doesn’t happen, there are plenty of companies that can make an investor “10, 20, 50 to 100 times their money.”

“It doesn’t have to be a 1,000 times or a billion dollar company. There’s lots of money to be made and lots of attractive businesses that are acquired all the time,” he said.

He added business and commercial real estate go hand in hand. A QOZB can’t thrive in an opportunity zone if it doesn’t have the space to open or expand, while an office building in an opportunity zone can’t fully succeed if it doesn’t have the right tenants. Both industries need to support each other, Phillips said.

“I think there’s a great marriage happening or [that] will happen [with this program],” he said.

Originally published by bisnow.com

Effective immediately, QOZB Capital has raised the yield on its Zero Coupon Notes to an impressive 10% APR.

Among the myriad applications of blockchain, decentralized finance (DeFi) has emerged as a revolutionary force, offering novel ways to earn yields for opportunity zone businesses.

QOZB Capital is building a toolkit for the QOF / QOZB industry. Our products can help to deliver capital protection, planning, and modern technical infrastructure to developers and fund managers.

Join us in moving the opportunity zone industry forward towards maturity.